Are Books Zero Rated Vat

This means they.

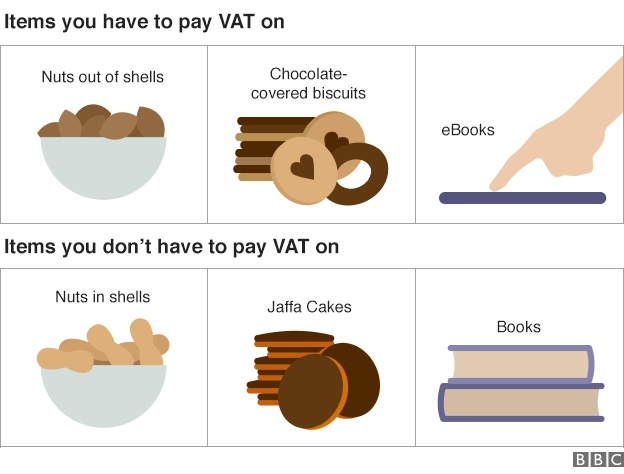

Are books zero rated vat. You can read more about vat on goods sent overseas. Printed matter liable at the zero rate the zero rate of vat applies to printed books and booklets including. Zero rated goods are products for which value added tax vat is not imposed.

The vat rate chargeable for printing depends on the publication product being printed. The vat act 1994 schedule 8 group 3 item 1 zero rates books booklets brochures pamphlets and leaflets the words in group 3 are used in their ordinary everyday sense. Goods exported outside the uk and the eu or sent to someone registered in an eu country are zero rated subject to conditions.

Items that are entitled to the vat zero rate. For example the printing of books is zero rated while the printing of newspapers is liable to vat at the second reduced rate. The words in group 3 are used in their ordinary everyday sense.

They may be printed in any language or characters including braille or. Books vat. A vat registered person may issue separate invoices receipts for the taxable exempt and zero rated component of its sales provided that if the sales is exempt from value added tax the term vat exempt sale shall be written or printed prominently on the invoice or receipt and if the sale is subject to zero percent 0 vat the term zero rated sale shall be written or printed prominently on the invoice or receipt.

Zero rated goods may include certain food items goods sold by charities equipment such as wheelchairs for the disabled medicine water books children s clothing etc. Sections 1 to 8 of this notice explains the nature of and the circumstances when you can zero rate books. Food and drink.

The format of the group 3 items. Zero rated means that the goods are still vat taxable but the rate of vat you must charge your customers is 0. You still have to record them in your vat accounts and report them on your vat.