Are Books Zero Rated Or Exempt From Vat

Transcripts or print outs made of such information are zero rated if they are supplied in the form of books booklets brochures pamphlets or leaflets as defined in section 3.

Are books zero rated or exempt from vat. As the zero rating of books makes people more eager to buy books it is one of the most effective ways of promoting book culture literacy and reading. You can read more about vat on goods sent overseas. Don t get stung because of a little misunderstanding.

Zero rated goods are products for which value added tax vat is not imposed. Goods exported outside the uk and the eu or sent to someone registered in an eu country are zero rated subject to conditions. A zero rate provides the necessary support for the entire publishing chain from author to publishers bookshops and libraries.

Exports 19 basic food items illuminating paraffin goods which are subject to the fuel levy petrol and diesel international transport services farming inputs sales of going concerns and certain grants by government. It wasn t till i read the story of a guy who sold motorbike equipment who got a whopping tax bill over 25k did i. In the uk the normal vat on goods are 17 5 but since vat is a hidden tax there is no way to identify whether a good is zero rated or not.

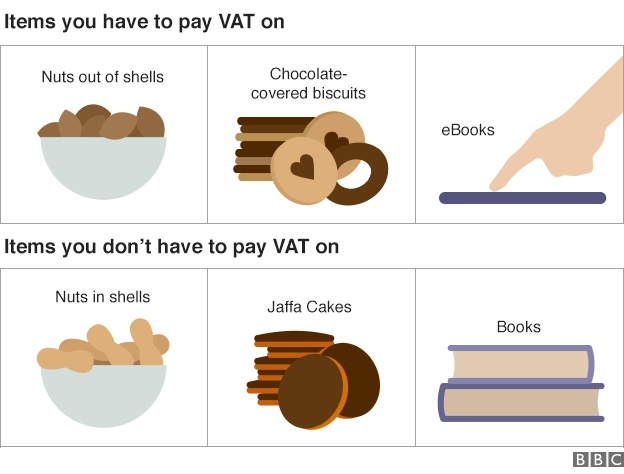

Goods and services exempted from vat are. Exempt zero rated no vat it s all the same right. Zero rating of books etc acrobat pdf 250kb 3 1 books and booklets these normally consist of text or illustrations bound in a cover stiffer than their pages.

Zero rated items are goods on which the government charge vat but the rate is currently set to zero. The goods covered by this classification are items such as children s clothes and footwear water basic foods books and newspapers. Zero rated goods may include certain food items goods sold by charities equipment such as wheelchairs for the disabled medicine water books children s clothing etc.

Suppliers do not charge tax on a zero rated or exempt supply. Even though there is no vat on zero rated supplies the zero rate is a rate of tax and businesses that make only zero rated supplies can register for vat and recover the vat on their costs and overheads. The retailers who sell zero rates goods can recover the vat on the costs that they incurred on any.